Content

Below is an overview, including how to use the market-to-book ratio when evaluating stocks. The concept can also be applied to an investment in a security, where the book value is the purchase price of the security, less any expenditures for trading costs and service charges. You can calculate accumulated amortization directly or first calculate yearly amortization like below. Multiply the yearly depreciation by the number of years that the asset has been in use to get the accumulated depreciation. The amount of depreciation may be calculated by using different methods, depending on the assets. Kristen has her Bachelor of Arts in Communication with certificates in finance, marketing, and graphic design.

Monthly or annual depreciation, amortization and depletion are used to reduce the book value of assets over time as they are “consumed” or used up in the process of obtaining revenue. These non-cash expenses are recorded in the accounting books after a trial balance is calculated to ensure that cash transactions have been recorded accurately. Depreciation is used to record the declining value of buildings and equipment over time. Amortization is used to record the declining value of intangible assets such as patents.

What is the Book Value Per Share?

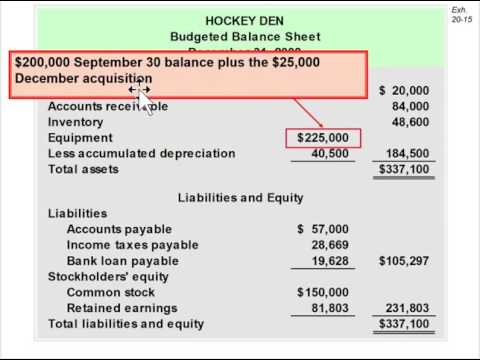

To Understanding Book Value, Formula, How to Calculate the book value of the business as a whole, the balance sheet can be used. To calculate the book value of a company from the balance sheet, simply deduct the amount of total liabilities from the amount of total assets.

- However, these targets are mostly arbitrary and are not relevant for all companies.

- Monthly or annual depreciation, amortization and depletion are used to reduce the book value of assets over time as they are “consumed” or used up in the process of obtaining revenue.

- At the beginning of 2022, Tesla stock was trading for $120.94 per share, with a market cap of USD $406 billion.

- As noted above, the company type, age, growth, and other factors also play a role.

- How to Invest in Real Estate When investing in real estate, you have multiple options.

Short-term assets, or current assets, are those that can be converted into cash quickly. This means these assets can be expected to generate cash in a short amount of time if sold. Short-term assets are not depreciated as they are only kept by the company until they are converted into cash, such as inventory, accounts receivable, and prepaid expenses.

What does the Book Value Per Share Indicate?

That number is constant unless a company pursues specific corporate actions. Therefore, market value changes nearly always occur because of per-share price changes. Market value—also known as market cap—is calculated by multiplying a company’s outstanding shares by its current market price.

- Assets may also be long-term assets, or noncurrent assets, which means they are the assets the company expects to keep and use for years at a time.

- It is a dollar amount computed based on the current market price of the company’s shares.

- Book value per share relates to shareholders’ equity divided by the number of common shares.

- A total of $50,000 of accumulated depreciation has since been charged against the machine, as well as a $25,000 impairment charge.

- Enterprise value is a measure of a company’s total value, often used as a comprehensive alternative to equity market capitalization that includes debt.

- Also known as shareholder’s equity or stockholder’s equity, this amount is equal to the company’s assets minus its liabilities.

If the value of BVPS exceeds the market value per share, the company’s stock is deemed undervalued. The book value refers to the value that is placed on an item based on its original cost.

The purpose of calculating book value

The original cost of the refrigerator was $1,140, and accumulated depreciation over five years was $333.33. It is important to note that the net book value of an asset will depend on the depreciation method being utilized by the company.

The process of depreciation is no longer required once accumulated depreciation reaches the original cost of the asset. Depreciation must be considered to obtain a reasonable value for an asset that has been used over time. As mentioned, depreciation refers to the decrease in the value of an asset because of its use. Accumulated depreciation refers to the total depreciation over the years as the item is used. So, if an asset depreciates by $50 per year, after three years the accumulated depreciation would be $150. Depreciation can be accounted for using various formulas, which may be more specific depending on the type of asset that is depreciated. However, there is a simple way to calculate the depreciation for any asset.

How to Increase the Book Value Per Share

Book value per share is the portion of a company’s equity that’s attributed to each share of common stock if the company gets liquidated. It’s a measure of what shareholders would theoretically get if they sold all of the assets of the company and paid off all of its liabilities. Many investors will use BVPS to find out if a certain stock price is accurate. An investor can compare the BVPS of a stock to its market value and see how they compare.

This amount will be equal to shareholder’s equity, which is the book value of the company. Book value is equal to the cost of carrying an asset on a company’s balance sheet, and firms calculate it by netting the asset against its accumulated depreciation. As a result, book value can also be thought of as the net asset value of a company, calculated as its total assets minus intangible assets and liabilities. The quotient will give you the price per share of equity, also called the book value of equity per share.

What Is Book Value?

At the beginning of 2022, Tesla https://personal-accounting.org/ was trading for $120.94 per share, with a market cap of USD $406 billion. It’s worth noting that some sources use slightly different formulas to calculate book value.

What is the formula to calculate book value of an asset?

Book value of an asset = total cost – accumulated depreciation. Book value of a company = assets – total liabilities. Book value per share (BVPS) = (shareholders' equity – preferred stock) / average shares outstanding.

Because of its relationship to depreciation and amortization, NBV should slowly and predictably decrease over time. The carrying value of an asset is its net worth—the amount at which the asset is currently valued on the balance sheet. Even if a company has a high book value per share, there’s no guarantee that it will be a successful investment. This is why it’s so important to do your homework before making any investment decisions.